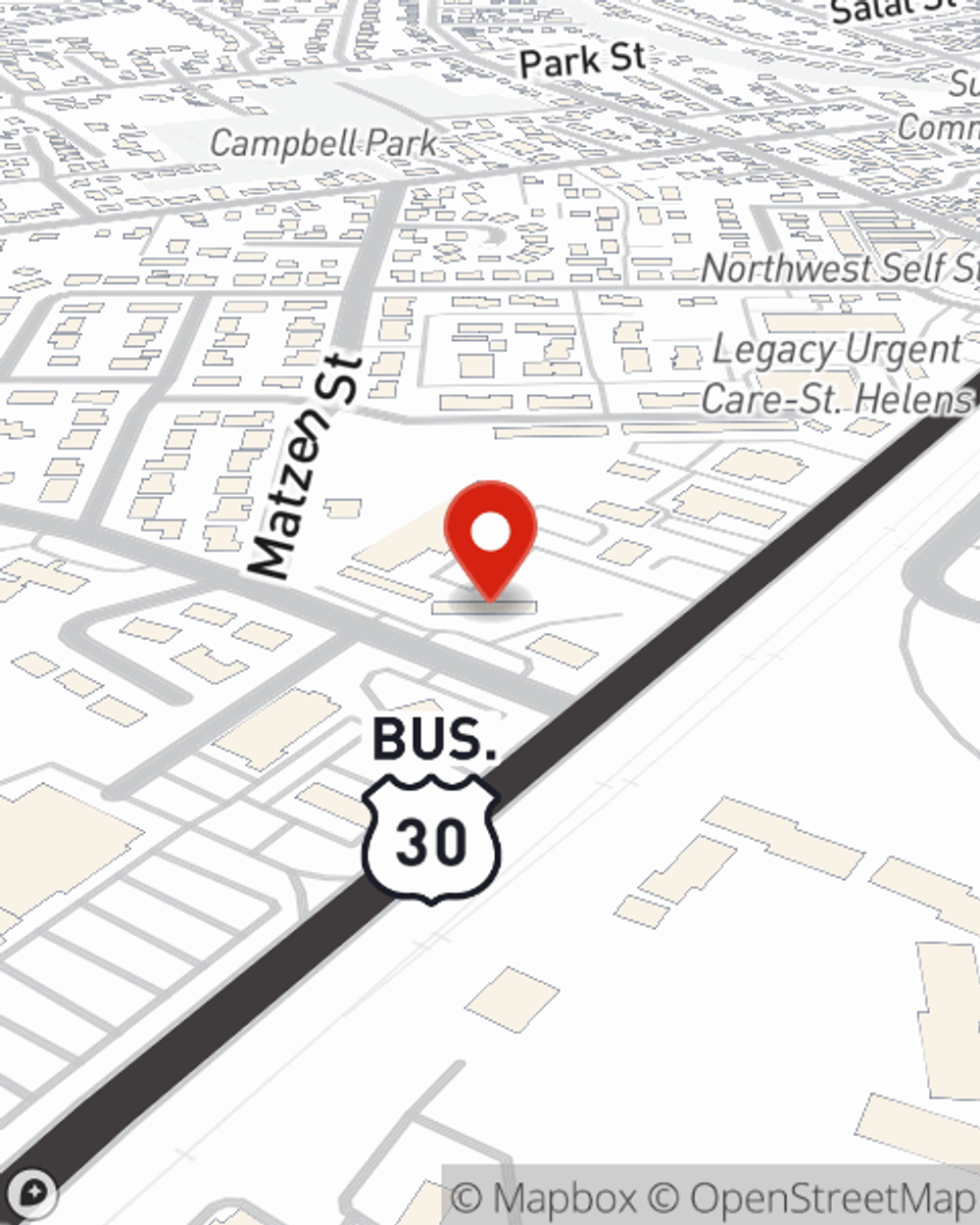

Business Insurance in and around St Helens

Get your St Helens business covered, right here!

Almost 100 years of helping small businesses

Help Protect Your Business With State Farm.

When you're a business owner, there's so much to remember. It's understandable. State Farm agent Joel Avina is a business owner, too. Let Joel Avina help you make sure that your business is properly covered. You won't regret it!

Get your St Helens business covered, right here!

Almost 100 years of helping small businesses

Cover Your Business Assets

For your small business, whether it's a barber shop, an appliance store, a pizza parlor, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like loss of income, equipment breakdown, and business property.

When you get a policy through one of the leaders in small business insurance, your small business will thank you. Call or email State Farm agent Joel Avina's team today to discover your options.

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Joel Avina

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".